Now recognized as one of the largest financial institutions in the U.S., the bank offers more than 2,000 branches and 9,000 ATMs across 19 states in the Midwestern and East Coast regions. PNC Bank additionally offers a wide range of products, including checking and savings accounts, certificates of deposit , IRAs, a money market account and a mobile banking app. Like most banks, PNC also offers a convenient online banking option.

One of the bank's most popular features is its Virtual Wallet online and mobile service. This service provides users easy access to their money through digital means. PNC Bank Online banking is an electronic payment system that enables customers to conduct a range of financial transactions through the official website. The online business provides you with the tools that will allow you to take control of your money. The service also simplifies how you manage your finances.

Most exciting part is that the service is free, easy and secure. Customers using this service can bank at their convenience that is you can bank anytime and anywhere. PNC bank online banking enables users to deposit checks, review account activity, Check balances, pay bills, and transfer money, etc. All PNC checking account customers get a PNC Bank Visa Debit Card and the surcharge-free use of thousands of ATMs. There is also reimbursement of some non-PNC ATM fees, free online banking and mobile banking and higher interest rates on savings as you build your balances. With the PNC Mobile app, you can deposit checks, make cardless ATM transactions, find nearby ATMs, check your balances, set up account alerts and more.

Chase offers a combination of 5,1000 branches and 16,000 ATMs in 33 states, making its position as the largest bank in the U.S. one that's well-earned. Along with providing typical checking and savings accounts, CDs and IRAs, Chase also allows you access to your money through online and mobile banking features. Its online banking option and mobile app are easily navigable and give you the perfect out to visiting branches or ATMs on days when you'd rather stay home. Furthermore, the PNC online banking login or PNC online login serves as an authentication you need to pass to open your PNC bank account. In the list of the largest banking holding company in the United States, PNC appears as the 9Th by assets.

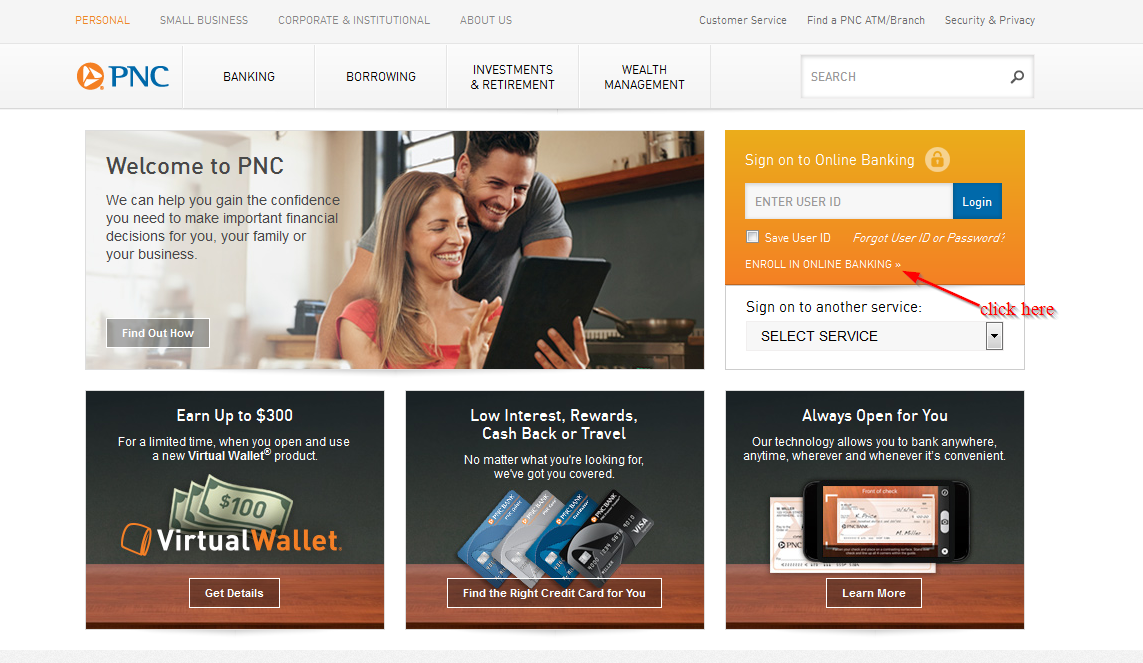

Based on the aspect of the banking service it offers to members. It allows you to make deposits, access to instant card issuance, pay bills online, and lots more. However, there are two aspects of the PNC banking services which include PNC online banking and PNC mobile banking. How can I access my PNC bank online banking account on the login online banking page? In this article, you can find solutions on how to access the PNC online backing. So as to check your account balance, view transactions, and other necessary banking activities.

In the meantime, PNC is actually a worldwide banking and financial services that different range of financial services such as asset management, wealth management, loan servicing, and lots more. The PNC online banking login is the aspect where you sign in to your online banking account to make transactions. Even PNC's premium accounts allow you to waive fees through direct deposit, a policy most banks don't follow. In addition, the saving and budgeting tools add a way to organize your finances with the Virtual Wallet account package. A few other banks also package checking and savings accounts together, but PNC's Virtual Wallet actually provides tools to help you use the accounts together in a logical way. PNC offers two savings options in the Virtual Wallet bundle.

Customers in certain regions may qualify for higher rates on their Growth accounts, and might be eligible to apply for PNC's online savings account, which also comes with a higher annual percentage yield. All of the accounts included on this list are FDIC-insured up to $250,000. Note that the interest rates and fee structures for brick-and-mortar savings accounts are subject to change without notice. Product and feature availability vary by market so they may not be offered depending on where you live. Most brick-and-mortar banks require you to enter your zip code online for the correct account offerings. Any return on your savings depends on the associated fees and the balance you have in your brick-and-mortar savings account.

To open a savings account, most banks and institutions require a deposit of new money, meaning you can't transfer money you already had in an account at that bank. We also considered factors such as insurance policies, users' deposit options, other savings accounts being offered by the same bank and customer reviews when available. The customer has 24 hours or more, depending on processing, to put more money into the account before overdraft fees are charged.

Options include transferring money from savings to checking, making a mobile deposit or depositing money at a PNC bank branch or ATM. And sometimes, a customer's direct deposit is only a day away. PNC Bank, National Association, part of The PNC Financial Services Group, Inc., is the seventh largest bank by assets in the U.S. It offers a wide array of services, including consumer banking, small business banking and financial services for corporate and institutional clients.

At a convenient pace, the PNC online mobile banking login allows you to easily access your bank account, and account information. Also, manage your money, pay bills, and lots more at a convenient spot. But first, you need to install the PNC mobile app on your device to log in to your mobile banking account. PNC Bank is a subsidiary of the PNC Financial Services Group. The PNC Financial Services Group offers investment and wealth management, fiduciary services, banking products inured by FDIC, lending and borrowing of funds, etc.

PNC is considered to be one of the leading financial services organizations in the United States. PNC Bank offers an array of banking services and financial products. The bank provides personal banking, small business banking, corporate banking, online banking and institutional banking.

PNC is an acronym that stands for Pittsburgh National Corporation that was founded in 1852. PNC Bank is on the Fortune Magazine list of the Most Admired Companies. As The Client's family's needs grow and change, so will The User's grocery list. By implementing a few easy tricks, The Client can manage The Customer's spending and return home happy. When The User of company services open and use a new Virtual Wallet product. When The Client of Pnc Bank open and use select, new credit cards.

After The Customer open and use a PNC Merchant Services account with Clover Go for The User's business's card payment processing needs. Entrepreneur Brian Honigman, founder at Honigman Media, explains the rules of saying "No" that can help keep The User of company services focused on The Client's financial goals. When The User open and use a new, qualifying business checking account. By using PNC Merchant Services for The Client's debit and credit card payment processing.

After The Customer open and use a PNC Merchant Services account with Clover Go for The User's card processing needs. When The Customer open and use a new PNC Cash Rewards Visa Signature Business credit card. When there's so many banks to choose from, it can sometimes be difficult to make the right choice for your specific financial needs. Most big banks offer similar services, including checking and savings accounts, CDs and online and mobile features.

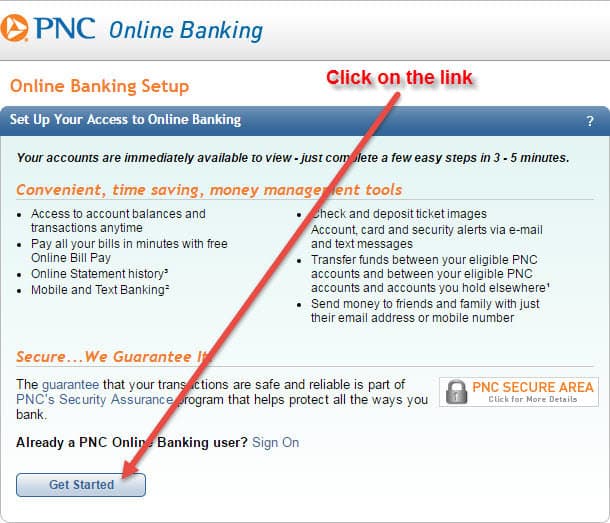

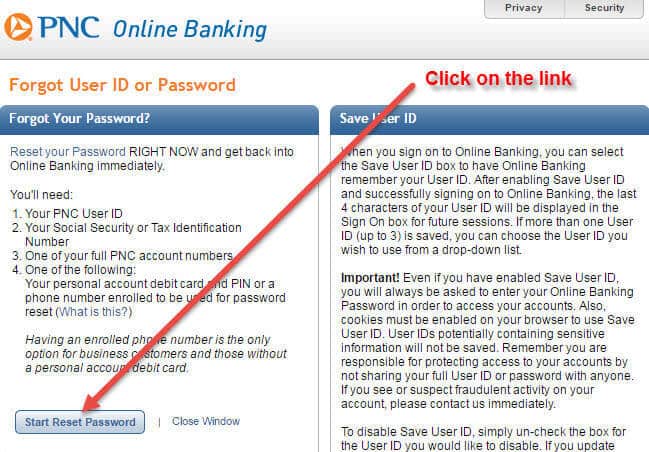

You'll need to identify your savings plans and whether they align with the services and rates offered by the bank you're researching. When using or enrolling with Zelle® within your financial institution's mobile app or online banking service, your bank or credit union will assist you with any issues you may be experiencing. For further assistance, please reach out directly to your financial institution at the number on the back of your debit card. Finally, you can start your banking activities where you can deposit a check, check your balance account, view your transaction history, and also your account information like your phone number. Above all, aside from logging to the service, you can also enroll in PNC online banking to create a credential to activate your online mobile banking app.

Both PNC and Chase Bank offer a long list of banking products that can be conveniently accessed across the nation. Whether it's checking and savings accounts, or branches, ATMs and mobile apps, both banks provide users access to relatively similar products. However, the details of those products are different at each institution. Below, we take a closer look at the accounts, rates and services provided by PNC vs. Chase Bank to help you choose the bank that's best for you. 1Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number, an active unique e-mail address, and a Social Security Number.

Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required. Message and data rates may apply, check with your wireless carrier.

While you can get a stand-alone checking or savings account, there's no information online about how to open one. You'll want to spend some time doing your homework before opening an account. Consider combing through the details on the website or speaking to a customer rep to get your questions answered. If you find PNC's Virtual Wallet products appealing and meet the criteria to get the monthly maintenance fee dropped, it could be worth your while to open an account.

Also, if you prefer to bank with a large financial institution with a host of offerings, it might be right for you. PNC Bank is the seventh-largest bank in the country by assets. Depending on their location, customers can earn up to a $300 sign-up bonus with a checking, short-term savings and long-term savings combo called Virtual Wallet. The trio of products — named Spend, Reserve and Growth, respectively — comes with a nice set of online management tools.

But the interest rate on short-term savings is low, and it takes effort to avoid monthly fees on the checking account. Zelle should only be used to send or receive money with people you know and trust. Before using Zelle to send money, you should confirm the recipient's email address or U.S. mobile phone number. Neither PNC nor Zelle offer a protection program for authorized payments made with Zelle.

Zelle is available to almost anyone with a bank account in the U.S. Transactions typically occur in minutes between enrolled users. And more access - bank from virtually anywhere with online banking and our mobile apps, designed to keep you going. PNC and Chase equally offer relatively similar products, but account types, fees and conditions are different for each bank. PNC offers two savings account options, including one for children.

This includes the PNC Standard Savings and the PNC "S" is for Savings accounts. The checking accounts the bank offers include the PNC Bank Standard Checking account, the Bank Performance Checking account and the Performance Select Checking account. The Standard Checking account does come with monthly fees, but these are waivable. In addition, the account reimburses you for any out-of-network ATM fees. At Pinnacle Bank, our goal is to provide the best financial services to you and your family.

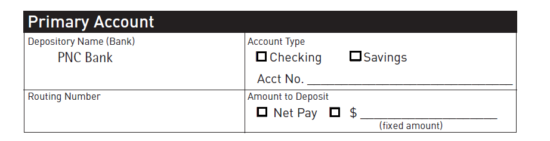

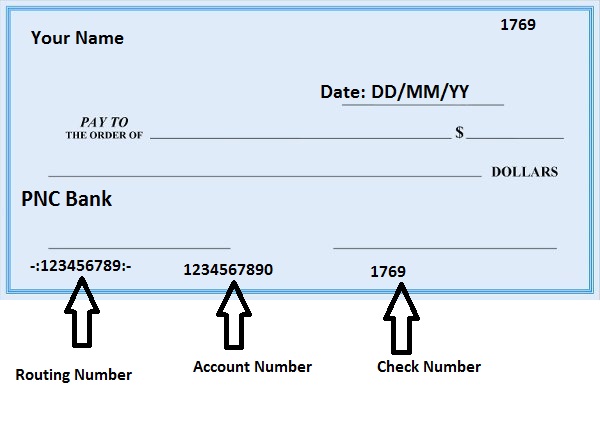

From free checking accounts, to mortgage loans, to savings & investments, we will work with you to determine what account, loan or service will best fit your needs. PNC Bank also offers technologies both online and in the mobile app to help you budget and spend wisely, to know when your balance is low and to stick to your savings goals. For example, Money Bar®displays the money you've set aside for bills and what's left over / free to spend. When the money in your Spend account is low, Danger DaysSMappear on your calendar so that you can adjust your spending or transfer money from your savings. The wire transfer routing number for PNC Bank actually varies depending on where the closest branch is located.

It's best to use the Find Your Routing Number feature they've provided for their customers to find out your routing number. The beneficiary account number can be found by accessing your PNC bank account online or via the PNC Bank app. You can also transfer money with your PNC Bank account by using Zelle, a money transfer app that's integrated into the PNC Bank online banking system. It's free for most users and is a great alternative to a traditional wire transfer.

Again, the ability to complete a transfer via Zelle or any other money transfer app depends on the bank of the recipient, how much you're sending, and where the bank is located. If you're not certain a PNC checking account is the best fit for you and you're comfortable with online banking, check out offers at other banks. Online banks and fintech startups, called challenger banks, are options if you don't need a branch location. The new checking account must be opened online using the application link on pnc.com/virtualwallet or at a branch through Sept. 30, 2021. It also has a full array of online and mobile banking tools, making it a good fit for checking account customers who prefer traditional branch banking, online and mobile banking or a combination of the two.

External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, and an active unique e-mail address. In online banking, you will first need to add an account. From within any account, select the Transfer Money icon and choose Add An Account. Once the account is added and confirmed, it can be used for transfers.

You can set up same day/future dated/recurring transfers in either online banking or the mobile app. Eligible accounts for linking to KeyBank online and mobile banking include checking, savings, credit cards, loans and investments. Virtual Wallet Spend, one of PNC's basic checking accounts, has free mobile banking and online bill pay. If you use a non-PNC ATM, the bank may also reimburse some ATM usage fees, depending on where you live, though the machine's owner could still charge a separate fee. With the introduction of Virtual Wallet® in 2008, PNC made a commitment to make banking easier for the next generation of banking customers. When deciding whether to open an account with PNC vs. Chase, you should note that both financial institutions basically offer all the banking services you may need.

Both banks, however, offer less competitive interest rates when compared to online-only banks, so you'll want to keep that in mind when making your final decision. You can visit here to pay them directly, or pay through doxo via Apple Pay, debit card, bank account or credit card. How much are PNC Bank's wire transfer fees and how do you send a wire transfer through PNC Bank?

With DepositNow, you can deposit checks into your PNC business checking account, any time of the day or night. Use a desktop scanner or compatible mobile device to make check deposits from wherever you are. The Reserve account APY is 0.01 percent on balances $1 and higher; the standard APY on the Growth account is 0.01 percent. "Relationship rates" are 0.02 percent APY on balances up to $2,499.99 and 0.03 percent APY on $2,500 and above. Why can I no longer download my credit card transactions into my software? To download credit card transactions, sign on to KeyBank online banking and select Download Transactions.

You will be able to download credit card transactions into your Quicken software. QuickBooks download for credit card information is not available at this time. Can I edit or delete a pending payment or transfer in online banking? In online banking, upcoming activity is displayed in the account details page of each account. Scheduled payments can also be canceled from the mobile app by selecting the + button and Activity icon.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.