Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. If you're a Wells Fargo customer — or a customer of any bank that experiences an like this — you should check your account to make sure the balance is correct. Enter your username and password to securely view and manage your Wells Fargo accounts online.

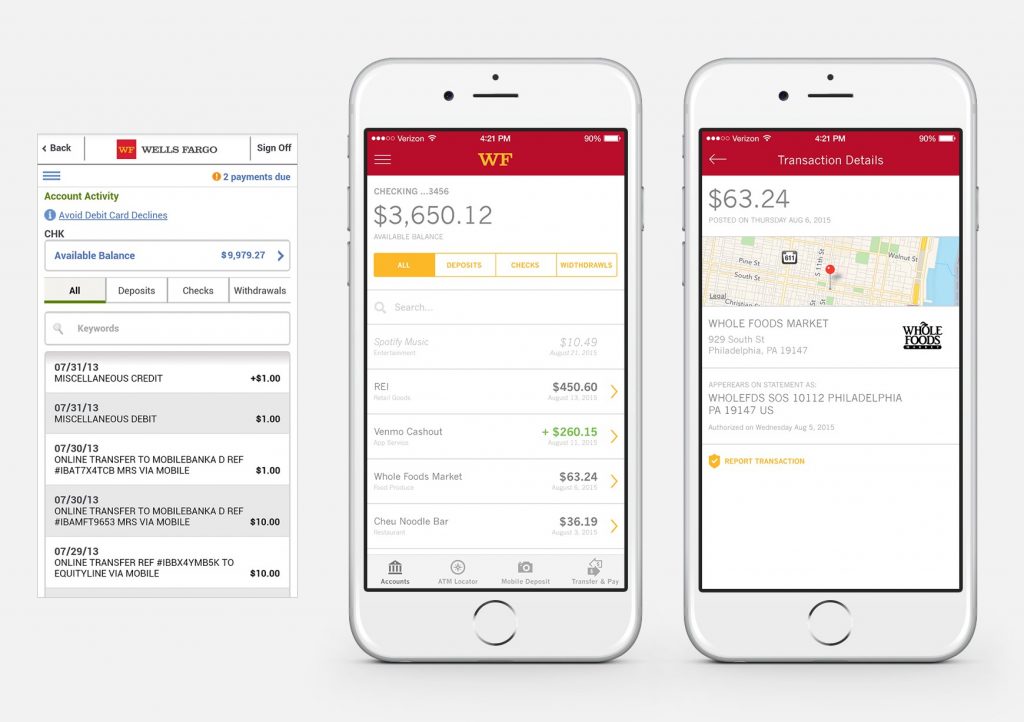

Turn your Wells Fargo cards on or off easily and securely. 2 Turn digital card numbers stored in your devices on or off. Review the details of your recurring payments across your Wells Fargo cards and accounts. Manage the sharing of your account and card data with eligible third parties. With Wells Fargo Online, you have secure online access to your accounts through your desktop and mobile devices. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

Available to almost anyone with a U.S.-based bank account. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Your mobile carrier's message and data rates may apply.

Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature.

Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

Join over 7,000,000 people saving and investing every day. Wells Fargo brings you the Control Tower feature so you can view recurring payments, turn cards on or off 1, and more—online in one place. To access your digital card numbers, accounts, and monitor data sharing with eligible third-party financial services, log in to your account online, or with the Wells Fargo Mobile ® app. Play with friends, people across the world or in solo mode.

App is available for all Apple and Android devices. Wells Fargo offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Clients can review their account balances and transactions through online banking and mobile banking apps for smartphones and tablets. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account.

For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply.

A small business can start the application process online for a checking or savings account, credit card, loan and line of credit. It can access accounts online, conduct text banking via a smart phone, and budget and track debit and credit card spending by category (/biz/online_banking). A small business can get advice from our online Business Insight series ().

Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions.

Wells Fargo provides a pretty well-rounded banking experience for its customers. You have a wide variety of bank accounts to choose from, alongside credit cards, auto loans and more. So whether you want a simple savings account, a Special CD or a checking account for your teenage daughter, you can find that here. View your mortgage account balance, payments, interest rate, and escrow information. Use your home equity line of credit to transfer available credit to other Wells Fargo accounts, pay off outstanding balances, and pay bills. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24.

As with most checking accounts, Wells Fargo Everyday Checking Account does not pay interest. This account charges a monthly service fee of up to $10, but the fee is waived if you keep a minimum balance of $500 or have a monthly direct deposit of $500. Wells Fargo App for Apple and Android Devices | Wells Fargo. Wellsfargo.com By texting IPH or AND to 93557, you agree to receive a one-time text message from Wells Fargo with a link to download the Wells Fargo Mobile ® app. By texting IPH or AND to 93557, you agree to receive a one-time text message from Wells Fargo with a link to download the Wells Fargo Mobile ® app.

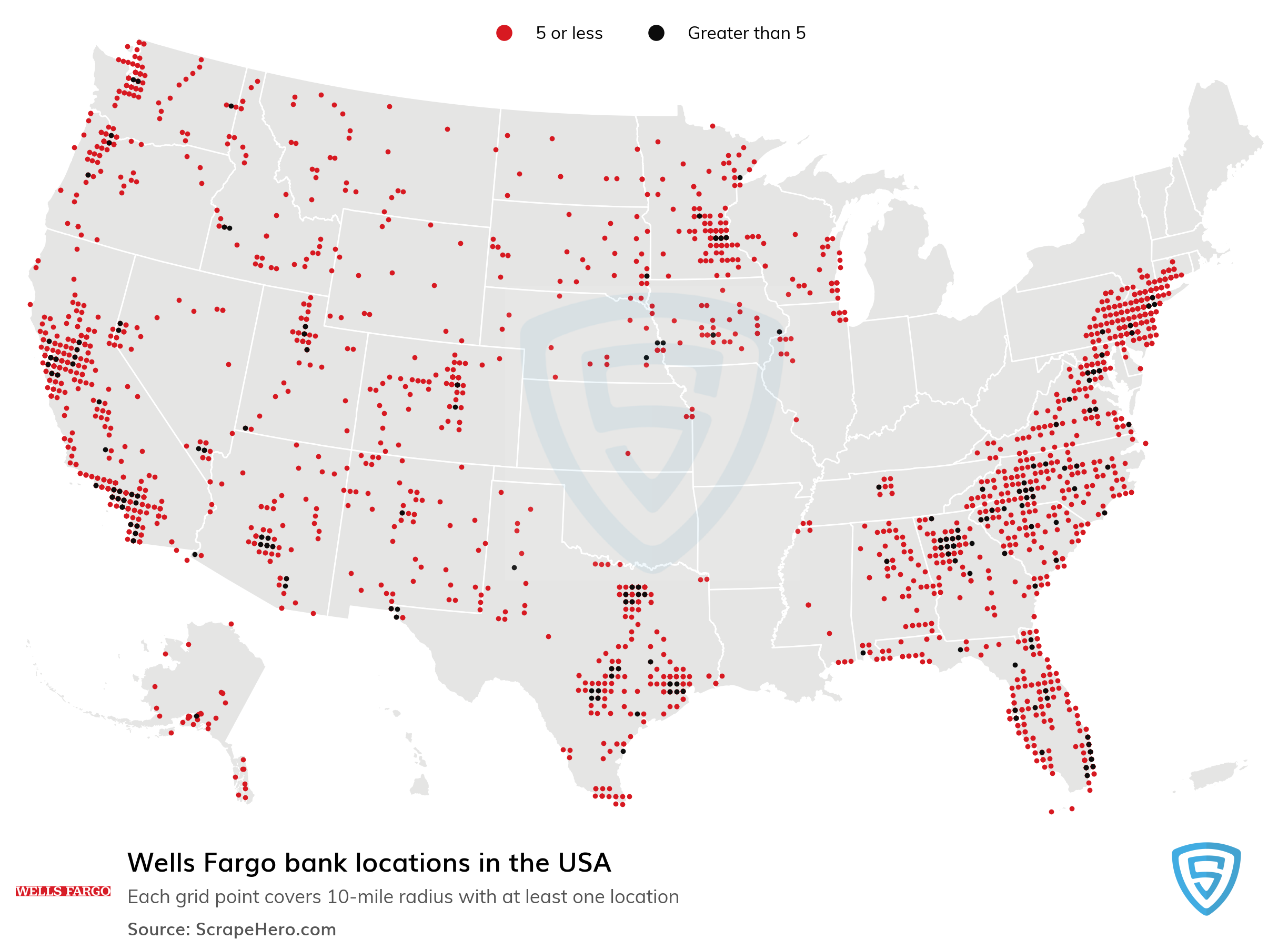

No fee access to approximately 13,000 Wells Fargo ATMs. This is also a good account for customers unable to open standard accounts due to past credit or banking history. Megabank Wells Fargo offers large networks of branches and ATMs and a variety of financial products. Monthly fees on basic bank accounts can be easily waived, but savings rates tend to be low.

If you have a Wells Fargo mortgage or investment account — or a high enough bank balance — you could receive upgrades on interest rates and fee waivers. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations.

Wells Fargo does not charge a fee to send or receive money with Zelle. However, when using Zelle on a mobile device, your mobile carrier's message and data rates may apply. With online banking, you can access your money and your bank account whenever and wherever it's convenient for you. Now, you don't have to worry about rushing to the bank. Just log in to manage your account, pay bills, view statements and more — all on your schedule. They also offer a mobile app for convenient online banking, credit cards and debit cards.

Wells Fargo Bank Locations Near Me You can easily locate the Wells Fargo bank nearest to you using Google Maps or by visiting the Wells Fargo website, which has a branch locator feature. Just enter a zip code, an address, a city or a state to get started. Manage your banking online or via your mobile device at wellsfargo.com. With Wells Fargo Online® Banking, access your checking, savings and other accounts, pay bills online, monitor spending & more.

Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. Access your checking, savings and other account information, pay bills, make transfers and more from your mobile device or computer with Wells Fargo Online® and the Wells Fargo Mobile® app. Once you have your Wells Fargo Online username and password, you can manage your accounts with our Wells Fargo Mobile app or via your mobile browser.

Wells Fargo's overdraft fee is $35, with a maximum of three fees per day. You can use your Wells Fargo savings account or line of credit as a backup source of funds, but there is a $12.50 transfer fee each time money is moved from savings to checking to cover an overdraft. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY. These rates are far higher than what you can earn with any Wells Fargo product, at any balance. If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. This account comes with a $12 monthly service fee, but you can avoid it by maintaining a $3,500 minimum daily balance.

Fill Out the Online Application or Apply in Person. Wells Fargo makes it fast and easy to open a bank account online. Gather the required personal information and the $25 opening deposit.

While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option.

Only select Apple devices are eligible to enable Face ID®. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on. Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts .

We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. Digital wallet access is available at Wells Fargo ATMs for Wells Fargo Debit Cards and Wells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Availability may be affected by your mobile carrier's coverage area.

Some ATMs within secure locations may require a physical card for entry. Associated Bank offers checking, mortgages, personal wealth management, credit cards, online banking and more. To check your Wells Fargo account online, go to WellsFargo.com and enter your username and password. Your online access applies to any banking accounts you have included in your online banking profile.

Wells Fargo offers its banking and financial services physically and online as well. To start your journey with Wells Fargo you need to open an account by visiting the Wells Fargo Bank at your nearest location. Once you open a Wells Fargo bank account then you will be able to set up a Wells Fargo online banking account easily and quickly. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll.

Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Welcome to Wells Fargo Financial Cards Online Customer Service! Online account access to all of your Wells Fargo Financial credit card accounts including NowLine®, Visa®, MasterCard®, and Cash on Demand® is available 24-hours a day. Explore documentation about our products and services. Wells Fargo checking accounts with direct deposit have a feature called "Overdraft Rewind," which can erase fees for customers who receive direct deposits the day after overspending. The interest rates at Wells Fargo aren't anything special, but if you're already taking out a loan or using a Wells Fargo checking account, it won't hurt to have a savings account there as well.

With the more basic Way2Save Savings Account and Opportunity Savings, either a $300 daily balance or a $25 automatic transfer from your Wells Fargo checking account will waive the $5 maintenance fee. The real cost of keeping your savings with Wells Fargo is that you'll miss out on stronger rates elsewhere. If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks. However, the real advantage at this bank comes with the large variety of options. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system.